Types of Business Asset Finance

This is legally an agreement to hire with the option to purchase at the end of the agreement. Spread the cost of a purchase over time by paying in instalments. The item appears on your company balance sheet and you are immediately responsible for maintenance and insurance costs. At the end of the purchase agreement, your business owns the asset.

A Finance Lease allows businesses to spread the cost of the full value of the asset over time, giving full use of the item without technically owning it.

With Contract Hire, businesses can enjoy full use of the asset over the hire agreement without the responsibility of ownership. Simply return the asset at the end of the agreement. This is a popular choice for vehicles.

An Unsecured Business Loan agreement doesn’t require Assets because they are based on the creditworthiness of the business. Most banks prefer secure loans where an Asset itself can act as security. This is a quick and simple service with decisions typically made within 24 hours of application. Repay in fixed monthly payments over 6 months to 5 years.

Working Capital Loans are used to finance a company's short-term day-to-day requirements. They are designed to inject cash into the business to enable it to make quick changes, such as going after new opportunities, employing extra staff for expansion or buying stock. Working Capital Loans are not generally used to purchase assets for long-term investments. They can help businesses grow quickly and/or manage their cash flow.

What is VAT Funding?

VAT funding helps businesses spread the cost of the VAT due on new equipment over a series of manageable monthly payments. Instead of paying the full VAT amount up-front, you keep cash in the business while still moving ahead with essential investments. It’s a simple way to protect working capital, avoid cash-flow pressure, and get the equipment into use from day one.

What are Corporation Tax Loans?

Corporation tax funding allows you to spread your upcoming tax bill into predictable instalments, rather than settling a large lump sum at once. This approach keeps cash available for growth — whether that’s taking on new projects, purchasing equipment, or supporting day-to-day operations. For many SMEs, it’s an effective way to balance tax obligations with strategic investment.

What is Confidential Invoice Discounting?

Confidential invoice discounting provides fast access to cash tied up in unpaid customer invoices, without changing the way you communicate with clients. You invoice as normal, but quietly receive an advance from the funder to boost your working capital. It’s a flexible option that can sit alongside asset-finance agreements, giving you more room to invest, plan, and keep your business moving.

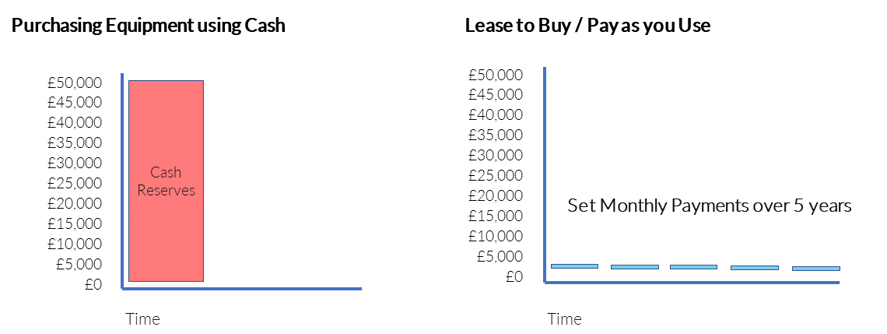

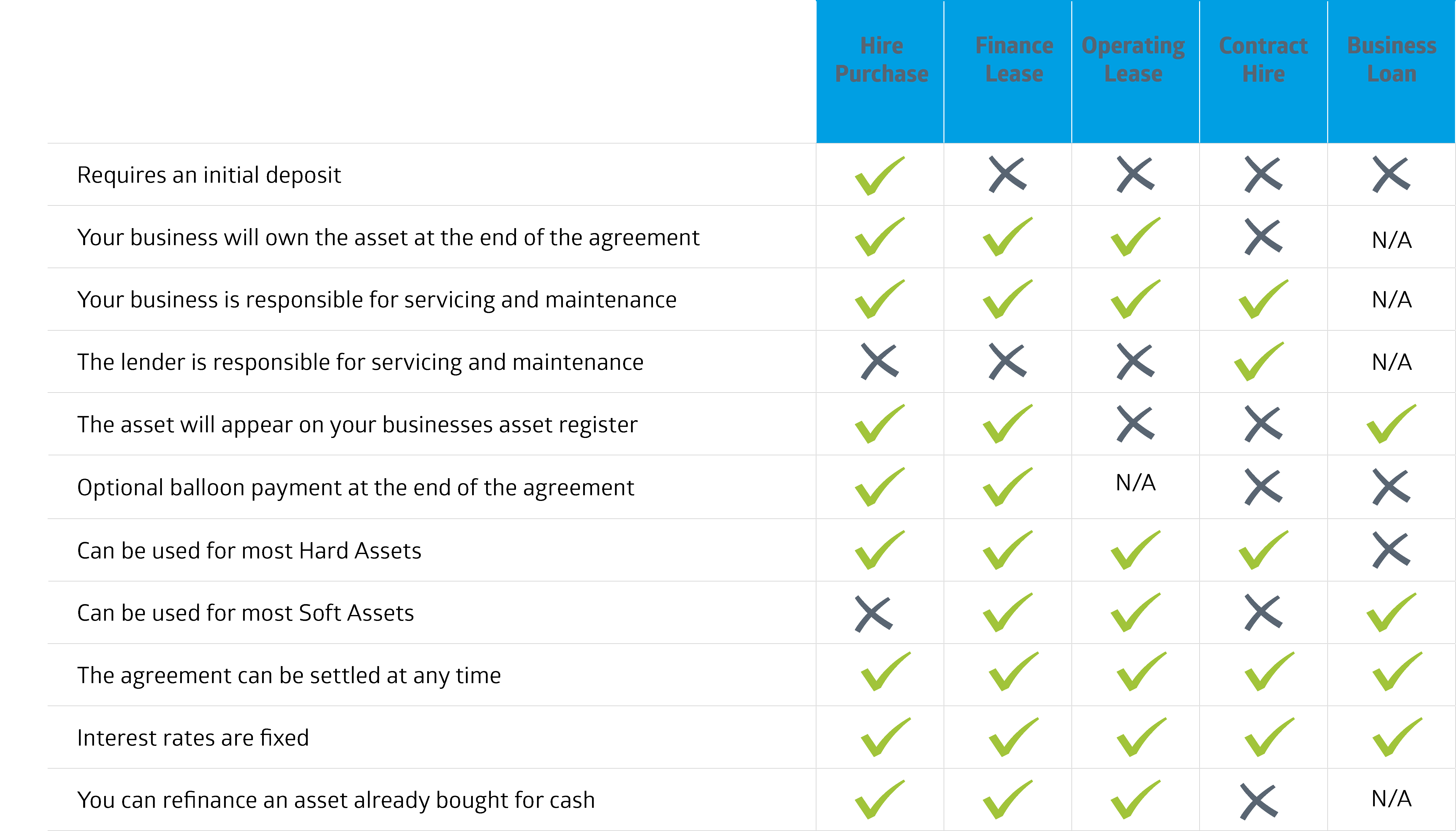

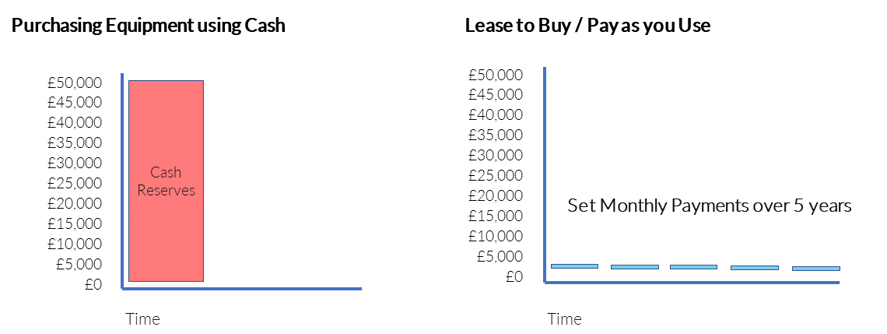

What type of Asset Finance is right for your Business?

Knowing which finance option is best for your business and the asset you are looking to fund can be a daunting task. To help with the decision, we've put together this simple comparison which summarises the main differences between finance options: